Test Preview: Need Analysis

Content Areas

To earn this credential, you will need to know the underlying principles of Title IV need analysis leading to the determination of the student aid index (SAI), including the three formulas used to calculate the SAI and the qualifications for a maximum or minimum Pell Grant . This will enable you to demonstrate the ability to ensure the use of accurate and appropriate SAI calculations, which directly affects the equitable distribution of financial aid funding.

Note: You are not expected to know Institutional Methodology (IM), which falls outside of the scope of determining eligibility for the Title IV aid programs.

The range of topics in this test include:

- General Concepts of Need Analysis

- The Student Aid Index Formula

- SAI and Pell Grant Eligibility

Tests may include questions pertaining to a variety of program structures, such as credit- or clock-hour, term or nonterm, standard or nonstandard term, undergraduate or graduate/professional programs, and programs of various length (shorter than one year, two-year, four-year, certificate, etc.).

Sample Test Questions

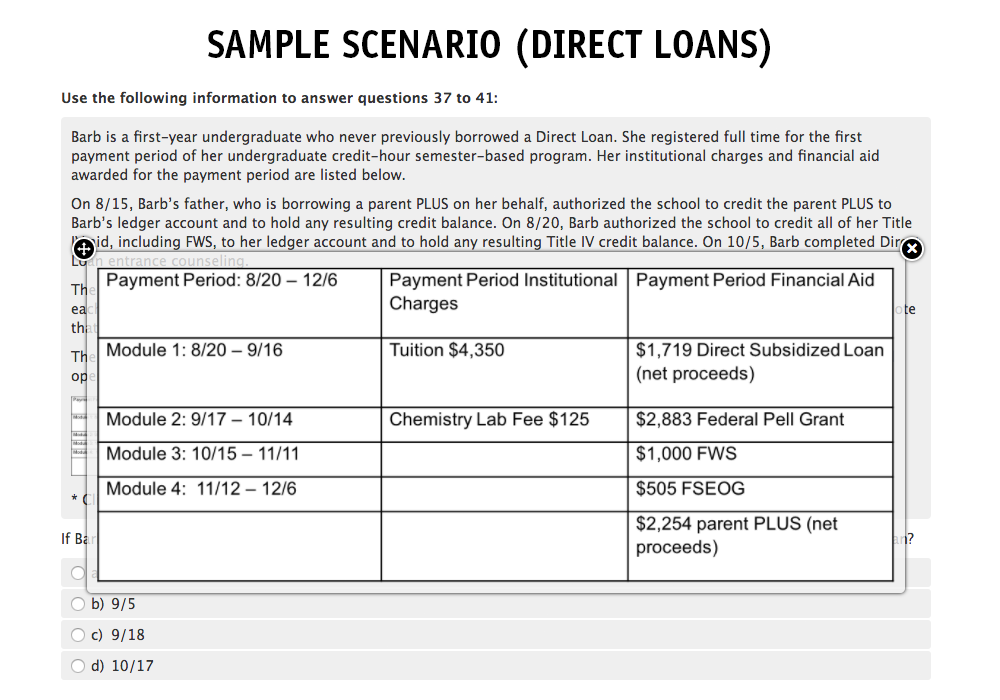

All tests will include a combination of multiple-choice and scenario-based questions. Some questions may involve viewing or downloading worksheets, charts, and tables. Please ensure you have a calculator available while taking a credential test.

All tests will include a combination of multiple-choice and scenario-based questions. Some questions may involve viewing or downloading worksheets, charts, and tables. Please ensure you have a calculator available while taking a credential test.

Review the following examples, which are similar in structure and scope to the questions that will appear on the test for this topic. Check your answers by selecting the question's link.

1. If a dependent student qualifies for the maximum Pell Grant, then __________ assets will count toward the SAI.

- only student

- only parent

- neither student nor parent

- both student and parent .

- Formula A

- Formula B

- Formula C

- Formula D

- The student has a lower income protection allowance with Formula B than with Formula A

- The student has a lower payroll tax allowance with Formula B than with Formula A

- The student no longer qualifies for a maximum Pell Grant

- The student’s income is no longer reduced by the parent’s negative adjusted available income

Recommended Resources

Prepare for this test by reviewing related content in resources such as:

- Higher Education Act of 1965, as amended (view U.S. Code Title 20, Chapter 28)

- Federal regulations (view NASFAA’s Compiled Title IV Regulations)

- U.S. Department of Education guidance:

- Student Aid Reference Desk