Myths and Realities about Rising College Tuition

by David H. Feldman

The list-price tuition at U.S. colleges and universities has risen by roughly 7% per year since the early 1980s. The inflation rate has averaged just 3.2%. These are some of the numbers that fuel public anxiety about how to pay for higher education.

The story of rising tuition is complex. Unfortunately, much of the public discussion about the cost of attendance is too simplistic. To understand the reasons for rising tuition, and the effect that this has on families, we need to break down the forces that affect how tuition is set and that determine who pays the bill.

The Effect of Technology on College Cost

Tuition is a price that rarely reflects the full cost of a year in college. Unlike most things people buy, university education is heavily subsidized. These subsidies come from governments (state and federal) and from private giving. The price a student ultimately pays is influenced by complex need-based financial aid formulas. In addition, schools themselves may discount tuition individually, based on merit and financial need. The tuition rate printed in the catalogue and the net price faced by a particular family can be quite different, and often students won’t know their final cost until near the end of a six-month quest for admission.

A major driver of tuition is the actual cost of providing the service. This is what the schools themselves spend on their programming for students, and this is where we begin the story of the cost of attendance.

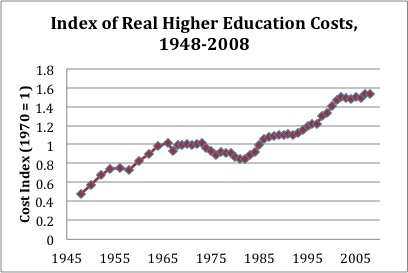

Figure 1 shows an index of the real cost of a year in college. If the index is rising, college cost is growing faster than overall inflation. Notice two things. The trend of the last 65 years is upward, and college cost generally rises faster than inflation. But this trend is not uniform. After rising in the 1950s and 1960s relative to the overall inflation rate, college cost declined in the 1970s, and then began a sustained rise in the 1980s that continues to this day.

Most stories about the rising cost of education highlight seemingly wasteful practices at colleges and universities—the “dysfunction narrative.” Frequently cited practices include prestige competition among schools for students and faculty, the system of faculty tenure, gold-plating the college experience with fancy amenities, and administrative bloat. This dysfunction narrative looks deeply into the higher education industry to find the darkness at its heart.

In our recent book, Why Does College Cost so Much?, my co-author Robert Archibald and I tell a very different story of rising college cost. We see higher education as just another industry within the landscape of the American economy. For us, the primary forces driving college cost upward are the technological changes that have reshaped the entire global economy over the past century. This is the context that is missing from the college-centric accounts of waste in the academy.

Figure 1

Technological change has acted on higher education in three ways. The first way is indirect. Labor-saving technological change has dramatically reshaped manufacturing and agriculture. This rising productivity has slowed cost growth in every industry that it has touched. It has also raised average living standards dramatically over the last century. In addition, this kind of technological change has reshaped the labor market to the disadvantage of the less-educated worker.

What technology has done for almost everything produced in a factory or farm setting, it has not done for education and for a set of similar personal services as diverse as medical and dental care, legal services, and live entertainment. In these artisan-like activities, the time spent with the service provider is the service, and for most of these services customers regard a decrease in contact with the service provider as a decrease in quality.

For example, schools could easily raise “output per labor hour” in education just by enlarging class size, but students and their families would be justifiably suspicious of this kind of productivity increase. Yet some productivity growth may be possible in education, and online instruction is indeed a growing trend. This subject, however, warrants an entire article. There may be natural limits to what online instruction can accomplish effectively. Much of what we consider quality education goes well beyond imparting basic factual knowledge, and human interaction remains the gold standard for teaching the thinking skills and learning techniques that likely will characterize tomorrow’s job market.

Without sustained growth in labor productivity, the normal economy-wide increases in the costs of plant, equipment, and personnel tend to push up the prices of most services more rapidly than the overall inflation rate, while the prices of manufactured products and agricultural commodities have generally grown more slowly.

Technological progress has produced two other important changes in higher education. First, innovation over the last 60 years has progressively raised the demand for workers with ever more years of formal schooling. However, since roughly 1980, the supply of educated labor has lagged the demand, so the premium that someone earns with a college degree has grown substantially. In 1980, the average college graduate only earned 45% more than the average high school graduate. Today, a college graduate’s wage is double that of a high school graduate. This change in the labor market pushes up cost in any industry that uses a lot of educated labor. Education is one such industry.

Lastly, colleges and universities tend to adopt new technology even if it raises cost. Faculty members need to be at the technological cutting edge to be productive teachers and scholars. And for our students to receive an education that prepares them for today’s labor market, they must be familiar with the current techniques in whatever discipline they study. We live in a time of rapid technological change, and this has been a force for rising cost across the curriculum.

This trio of technological forces explains the entire trajectory of college cost over the last 70 years. Even the cost downturn for higher education in the 1970s fits the story. At that time, global manufacturing productivity growth slowed dramatically, shutting down one engine of rising service prices for almost a decade.

Busting the Myths Surrounding Rising College Costs

The dysfunction narrative is the alternative tale of rising cost, and it is a sexier story with lots of villains. But it doesn’t fit the evidence very well. In this brief space I cannot address every part of that narrative, but a few choice nuggets of information should suffice.

Competition: If prestige competition were a driving engine of college cost, we would expect to see cost rising more rapidly in four-year schools than at community colleges. Four-year programs house the expensive research facilities and hire the superstar scholars. Yet the growth rate in expenditures per student at four-year and two-year programs is quite similar.

Administrative Bloat: Within the dysfunction narrative, any increase in the number of “administrators per student” is often taken as evidence of inefficiency. This notion is flawed on at least two grounds. Schools have dramatically reduced their clerical employment, and this raises the percentage of the employee base that is administrative. This is not a sign of inefficiency. At the same time, schools have added professional staff in everything from IT to counseling. But these same shifts are happening almost everywhere in the U.S. economy. The percentage of Americans who work in jobs classified as administrative has risen substantially over the last quarter century. This context is often missing from bloat stories, as is the benefit to student retention rates and graduation rates from the professionalized support staff available to help them.

Tenure: Lastly, faculty tenure and workplace culture have very little to do with college cost. For starters, tenure is a declining institution. The fraction of the faculty on tenure track has fallen steadily over the past few decades, especially at cash-strapped public institutions. Although the academy is not a particularly efficient institution, there is no good evidence that it has become more inefficient over time.

The Realities Are More Complex

The most important engine of cost growth in higher education is the fact that productivity growth in some industries, like manufacturing, has outstripped productivity growth in others, including artisan services like higher education. But this effect does not necessarily make college less affordable to the average family. Productivity growth, after all, adds to the nation’s income. To understand college affordability problems, we must look elsewhere.

Two features of the economic landscape have had a big effect on affordability. The first is a sea change in budget priorities in the states. In 1975, states allocated roughly $10.50 to higher education for every $1,000 of per capita state income. Today the figure is around $6.00, despite a massive increase in the number of students seeking postsecondary education. This type of budgeting has resulted in tuition increases at public universities, which have negatively impacted the availability and quality of their academic programs. The effect on affordability is clear. In 1975, the states picked up 60% of the tab for a year in college while families shouldered 33%. The federal government picked up the remaining 7%. Today, the states pay only 34% while families bear 50% of the cost. The federal government’s share, through grants and tax credits, is currently 16%. Much of this surge in the federal government’s share is a temporary response to the 2008 financial crisis and recession. Over the last 30 years, the federal share has normally been in the 10% range.

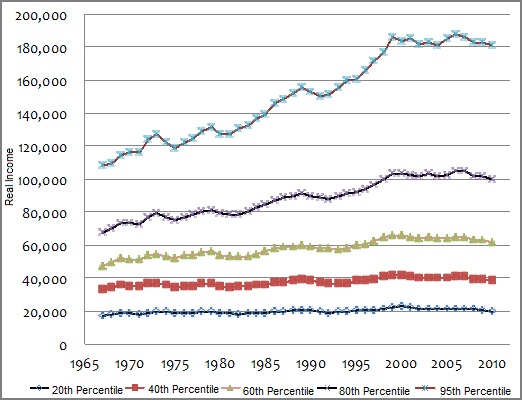

Over the same span of years, the income distribution in the United States has changed dramatically. This is another major force for creating affordability problems in higher education. In the 1960s, an average person with a high school diploma could live a comfortable, middle-income lifestyle. That statement no longer holds true. As people who were once solidly middle class find themselves falling further down the distributional ladder, their children increasingly find a college education more difficult to finance.

Figure 2 shows how the U.S. income distribution has changed over the last 45 years. Two things are apparent: First, the bulk of the income gains over the last generation have gone to people with above-average income; these people are mostly the well-educated. Second, over the last decade, all but the extremely wealthy (top 1-2%) have seen their real income stagnate. This is why the affordability problem has so captured the public’s attention in recent years. Even families with incomes well above the national median are feeling pinched.

Private schools have long used tuition discounting as a way to reach families whose personal finances make an expensive private program a financial stretch. But discounting is itself a force for pushing up the list-price tuition that wealthier families pay. Schools need revenues to finance their programming, and if they discount the price to some students who otherwise could not come, they must increase it for others who can pay.

Over the last 20 years, private universities have pushed the envelope on tuition discounting, and this has increased the average list price. In 1993, for instance, the discount rate at private universities was roughly 25%; ten years later it had reached 32%. This means that list-price tuition rose by 30% more than if the discount rate had remained the same. Coupled with rising tuition at cash-starved public universities, the result is that many upper middle-income families increasingly bear the full impact of rising list-price tuition at both public and private institutions.

Figure 2

No Easy Answers

The key affordability issues that I have highlighted are not easily solved with simple policy remedies like tuition caps. They reflect deep structural changes in the U.S. economy and in the states, and these changes have occurred over long stretches of time. Solving the affordability and access issues wrought by these changes requires policies that go well beyond tinkering with higher education programs. If we could restore the purchasing power of the middle-income family, many other social ills would be easier to manage. There is no magic wand that will do this, but sensible reform must start with an understanding that educational opportunity begins with improvements in K12 programming at the state level. This is the foundation of later success in college and in the labor market.

There are steps we can take to maintain access to higher education in this time of rapid technological change and widening income differences. Financial aid programs can be simplified so that students can make better choices earlier in the application process. There are sensible proposals on the table to reform the FAFSA process so that students and families can understand—much earlier in the application process—the real price of a year of college. The current complexity is a barrier that reduces access for students that come from poorer families. And finally, federal aid programs that are under threat annually need to be defended from the charge that they are the cause of runaway tuition increases.

David H. Feldman is Professor of Economics and Department Chair for the College of William and Mary in Williamsburg, Virginia. He and Robert B. Archibald coauthored the 2010 book, Why Does College Cost So Much? He presented “Costs, Subsidy, and Access” at NASFAA’s January 2012 forum, “The State of College Access.”

The opinions offered and statements made in Student Aid Perspectives articles do not imply endorsement by NASFAA or guarantee the accuracy of information presented.

Publication Date: 3/23/2012

Helen F | 3/26/2012 12:40:32 PM

Thank you so much for publishing this article. I studied this topic in my master's degree program at Portland State University, and ever since I learned about the real forces at work in rising tuition prices, the political sound bites on the topic have frustrated me terribly.

You must be logged in to comment on this page.