Test Preview: Direct Loans

Content Areas

To earn this credential, you will need to know the key characteristics of each of the three programs that make up the Federal Direct Student Loan (Direct Loan) Program, the qualifying criteria for each type of loan, and the factors affecting loan eligibility. You should know about the loan application process, the loan origination process, and mandatory loan counseling requirements. Additionally, you will need to be familiar with the major repayment features of Direct and FFEL loans. This will help you demonstrate the ability to assist current and future borrowers of Direct Loans, and ensure your school’s policies and procedures related to the awarding and origination of loans do not put your borrowers or your school’s participation in the Title IV programs at risk.

The range of topics in this test include:

- General Concepts of Direct Loans

- Factors for Calculating Loan Amounts

- Direct Loan Amounts and Limits

- Calculating Direct Loan Eligibility

- Loan Counseling

- Direct Loan and FFEL Repayment Features and Plans

Tests may include questions pertaining to a variety of program structures, such as credit- or clock-hour, term or nonterm, standard or nonstandard term, undergraduate or graduate/professional programs, and programs of various length (shorter than one year, two-year, four-year, certificate, etc.).

Sample Test Questions

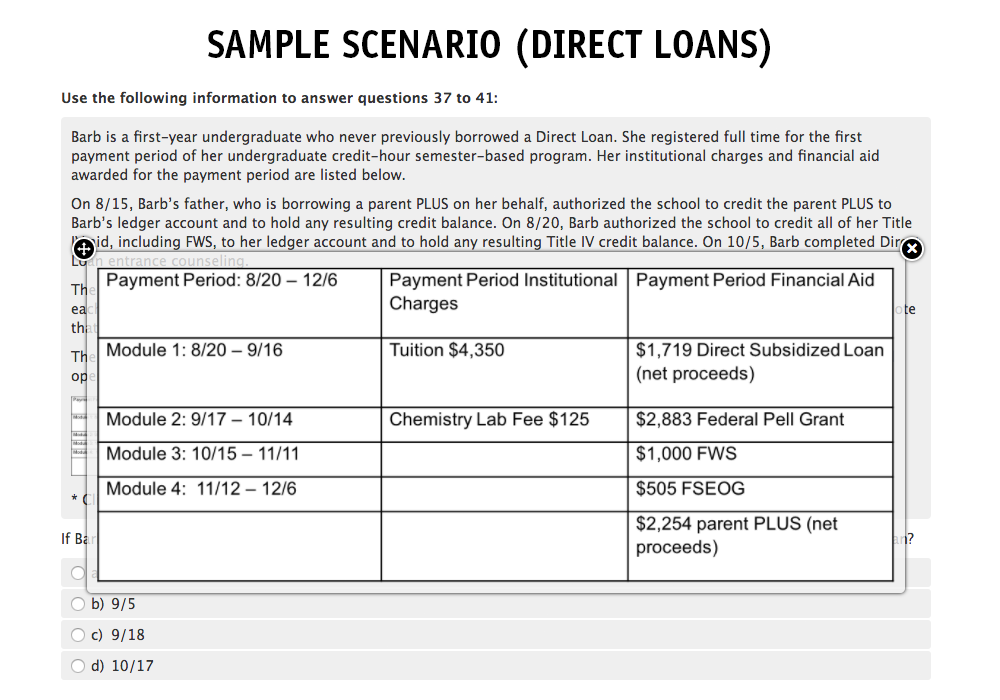

All tests will include a combination of multiple-choice and scenario-based questions. Some questions may involve viewing or downloading worksheets, charts, and tables. Please ensure you have a calculator available while taking a credential test.

All tests will include a combination of multiple-choice and scenario-based questions. Some questions may involve viewing or downloading worksheets, charts, and tables. Please ensure you have a calculator available while taking a credential test.

Review the following examples, which are similar in structure and scope to the questions that will appear on the test for this topic. Check your answers by selecting the question's link.

- aggregate loan amount

- annual loan amount

- remaining loan limit

- base annual loan limit

2. Which of these students would be subject to proration of the Direct Loan annual loan limit?

- Mandy, an undergraduate student who started attending mid-year

- Franco, an undergraduate student enrolled in a program less than an academic year in length

- Joe, an undergraduate student enrolled part-time for the fall, winter, and spring quarters

- Millicent, a doctoral candidate working on her dissertation

- interest accrues at a reduced rate.

- the federal government makes payments on the borrower’s behalf.

- payments are not required.

- partial payments are required.

- standard

- extended

- graduated

- income-based

5. Entrance counseling is required for graduate PLUS Loan borrowers who have not previously borrowed a

- Direct Subsidized Loan.

- Direct Unsubsidized Loan.

- Federal Family Education Loan.

- Direct PLUS Loan.

Recommended Resources

Prepare for this test by reviewing related content in resources such as:

- Higher Education Act of 1965, as amended (view U.S Code Title 20, Chapter 28)

- Federal regulations (view NASFAA’s Compiled Title IV Regulations)

- U.S. Department of Education guidance

- Student Aid Reference Desk