Issue Brief: Verification

October 2018

Key Takeaways

- Verification plays an important role in ensuring the integrity of federal student aid programs, but the process remains overly complex, disproportionately affects low-income students, and is burdensome for students and aid administrators.

- The Department of Education does not reliably release data on verification selection criteria or the degree to which verification results in changes to financial aid awards, making it impossible to assess its true impact on students or value to taxpayers.

- The only way to meaningfully decrease verification burden on students, while maintaining integrity in the financial aid programs, is to fix the FAFSA.

Verification

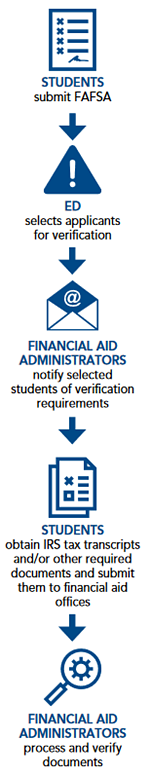

In order to qualify for federal financial aid, students must complete the Free Application for Federal Student Aid (FAFSA). Each year, the Department of Education (ED) selects millions of applications for further review. For those selected applications, schools are required to validate the submitted information to ensure accuracy of both the FAFSA data and the financial aid awarded. This additional step in the aid application process is called "verification," and remains a complicated and time-consuming burden for the students and families who are most in need of financial aid.

Verification Process

Verification Process

In 2014-15, the last year for which ED published verification selection data, 26 percent of applications were selected to be verified.1 Using an ED-developed risk model, students selected for verification are assigned to different verification tracking groups that specify the types of documentation they must submit to the aid office. Time to complete the verification process can vary widely. Many students are asked to provide an IRS tax transcript or verification of non-filing which, when requested by mail, can take more than 10 calendar days to obtain.

Verification Burden

While verification is an important step in maintaining the integrity of federal aid programs, it imposes significant costs on students and aid administrators.

Low-income Students

Almost all applicants selected for verification are eligible for the Pell Grant, as the federal government is especially concerned that Pell Grant dollars, which do not have to be paid back, are correctly awarded to the neediest students. According to ED data, over half of Pell-eligible applicants were selected for verification in 2015-16.2 Unfortunately, this means many of the lowest income students, or those most in need of financial aid, are targeted with heightened complexity, additional scrutiny, and delayed aid notification. It is estimated that more than 1 in 5 low-income students selected for verification never complete the process.3 In a 2016 survey of over 600 financial aid administrators, 71 percent agreed that verification placed unnecessary burdens on low-income students and families.4

Aid Notification and Delivery

The verification process can take weeks to complete. This has serious consequences for many students, especially those seeking to attend open-access institutions who sometimes file applications much later in the cycle. Of the 600 financial aid administrators surveyed in 2016, 34 percent said verification almost always or often resulted in award amounts remaining undetermined after the semester had started, and 56 percent reported that the process almost always, often, or sometimes resulted in students being unable to enroll on time.5

Financial Aid Office

Despite ED's efforts to streamline the verification process over the last decade, financial aid offices are still processing high verification volumes. In 2016, one in five surveyed aid administrators said verification took up more than 50 percent of their time, while only 10 percent said verification often resulted in a significant change to a student's aid package.6 Beyond anecdotal evidence, it is unclear whether verification fulfills its purpose of preventing federal student aid dollars from going to the wrong students because ED does not make public enough data to thoroughly evaluate process effectiveness.

Recent Trends in Verification

Over the last decade, ED has largely been unable to strike a balance between maintaining program integrity and eliminating unnecessary barriers for low-income students. The following developments and setbacks highlight the "one step forward, two steps back" pattern of recent verification adjustments:

IRS Data Retrieval Tool (DRT)

The introduction of the IRS Data Retrieval Tool (DRT), a resource that allows financial aid applicants to import tax information directly into the FAFSA, should have greatly reduced the need for verification beginning in award year 2012-13. Unfortunately, the DRT was disabled for large portions of the 2016-17 and 2017-18 processing cycles, preventing any meaningful verification reduction in recent years.

Prior-Prior Year (PPY)

The use of prior-prior year (PPY) income data on the FAFSA, which made the FAFSA available earlier and allowed more applicants to use the DRT, was implemented in award year 2017-18 and was expected to significantly reduce verification burden. The DRT makes tax data from two years prior readily available upon application, which, under PPY, allows more applicants to submit information already considered verified by the IRS. For this reason, PPY is crucial progress toward solving the verification problem. Unfortunately, the DRT went offline again that year, contributing to widespread confusion and soaring verification selection rates.

Institutional Cap

For many years, institutions were only required to verify up to 30 percent of their total applicant pool. However, ED removed this cap when it introduced targeted verification groups during the 2012-13 award year. Institutions now must complete the process for every selected student. Though ED may select fewer than 30 percent of applications overall, the distribution of selected applications can vary widely across institutions, leaving some campuses with a light verification burden and others overwhelmed.

Verification of Non-filing (VONF) Status

ED implemented a verification of non-filing (VONF) status requirement to all schools in 2016-17. Under this policy, all selected applicants who did not file a tax return must verify, by obtaining necessary IRS documentation, that they did not file. Students and parents must request a tax transcript from the IRS either online or by submitting a paper IRS Form 4506-T by mail, a process that can take weeks. VONF is a cumbersome and lengthy process, and ED has yet to provide data showing the practice is necessary to ensuring program integrity.7

What Congress Can Do

- Congress can apply pressure to ED to ensure greater transparency on verification selection rates, the necessity of VONF, and the degree to which verification detects significant submission errors.

- Congress can work with the ED to reinstate the the 30 percent cap on verification.

- The ultimate solution to verification burden is fixing the FAFSA. Simplifying and improving the FAFSA by expanding the use of the IRS DRT to include all 1040 line items and by auto-importing data already considered verified by other federal agencies, such as receipt of means-tested benefits, would greatly reduce the need for verification and its impact on low-income applicants. These and other provisions are included in NASFAA's FAFSA Simplification Working Group recommendations.

NASFAA Resources

- History of Changes to Financial Aid Verification - 2018 NASFAA infographic outlining the timeline of verification adjustments over the last decade

- What Went Wrong with Verification - 2018 NASFAA Today's News article outlining the verification problem and its recent history

- NASFAA Letter on VONF - 2017 NASFAA letter to ED requesting reprieve and review of VONF requirements and data transparency

- NASFAA FAFSA Working Group Report - NASFAA's comprehensive FAFSA simplification recommendations

- NASFAA Editorial: To freeze ‘summer melt' in its tracks, Congress must fix the FAFSA - 2018 Op-ed by NASFAA President Justin Draeger on the verification problem, published in The Hill newspaper

Other Verification Resources

- On the Sidelines of Simplification: Stories of Navigating the FAFSA Verification Process, Published by The Institute for College Access & Success in November 2016

- Income Verification for Federal Aid Hinders Low-Income Students by Ashley A. Smith, Published by Inside Higher Ed on October 12, 2018

- The Leaky FAFSA Pipeline, Published by the National College Access Network on December 7, 2017

- Colleges puzzled by surge in FAFSA verification requests by Danielle Douglas-Gabriel, Published by The Washington Post on November 28, 2017

1 U.S. Department of Education, FAFSA Application Processing and Verification Update (Presentation), https://fsaconferences.ed.gov/conferences/library/2015/2015FSAConfSessionGS2.ppt

2 U.S. Department of Education, Federal Pell Grant Program Annual Data Reports, http://www2.ed.gov/finaid/prof/resources/data/pell-data.html

3 National College Access Network, The Leaky FAFSA Pipeline, https://collegeaccess.org/news/news.asp?id=456419

4 The Institute for College Access and Success (TICAS), On the Sidelines of Simplification,

5 TICAS, On the Sidelines of Simplification

6 TICAS, On the Sidelines of Simplification

7 NASFAA Letter on VONF, https://www.nasfaa.org/uploads/documents/NASFAALetteronVONF.pdf

8 NASFAA FAFSA Working Group Report, https://www.nasfaa.org/uploads/documents/fafsa_report_1.pdf

Publication Date: 10/29/2018