Students Say Purchasing Course Materials Is Their Biggest Financial Stressor After Tuition

By Joelle Fredman, NASFAA Staff Reporter

After the costs of tuition, college students cite having to purchase course materials as their greatest financial stressor, which, according to a new study, has driven them to skip meals and take fewer classes — practices that can negatively affect their chances for academic success and eligibility for financial aid.

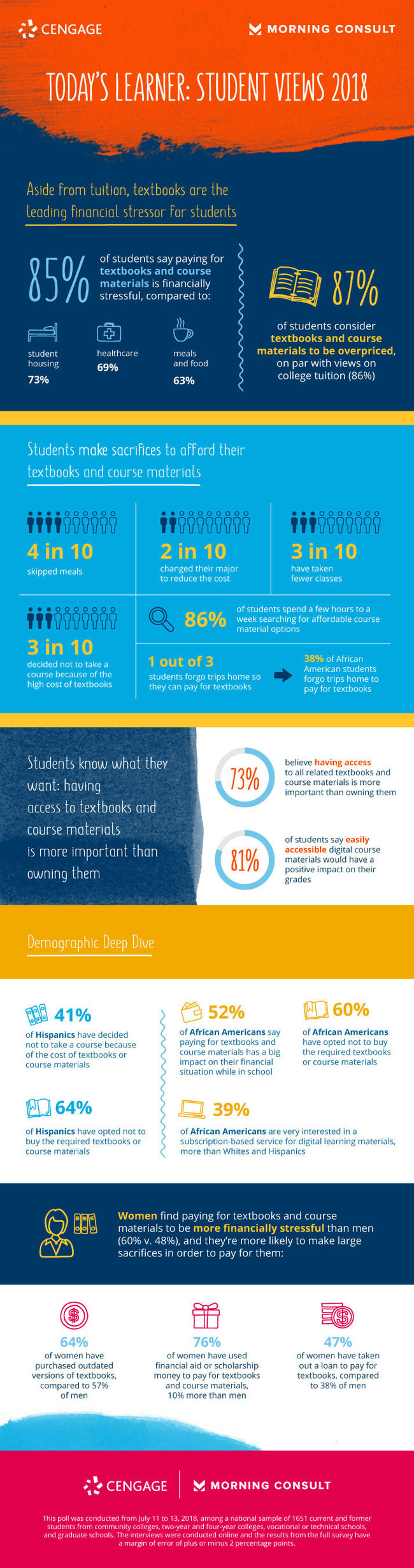

Cengage, the largest U.S. provider of higher education teaching and learning materials, commissioned a consulting company to conduct a survey of 1,651 college students and former college students in June and found that 85 percent said that buying textbooks caused them the most financial stress, falling just below tuition, which 88 percent of students said was their greatest burden. These figures were significantly larger than those who cited housing (73 percent), meals (63 percent), and healthcare (69 percent), as their most stressing financial obligations.

“The survey’s results should be a wake-up call for everybody involved in higher education,” Cengage CEO Michael Hansen said in a press release. “This is especially true for the publishing industry, including our own company, as we historically contributed to the problem of college affordability.”

The cost of textbooks has risen at a much faster rate than both tuition and housing costs, according to data from the Bureau of Labor Statistics. While between 2006 and 2016 the costs of tuition and housing increased by 63 and 50 percent, respectively, the costs of textbooks soared by 88 percent. The College Board found that for the 2017-18 academic year a student at a public, two-year college spent an average of $1,420 on books and supplies, and a student at a public four-year institution spent on average of $1,250 on course materials.

The survey also revealed that many students have taken drastic measures to afford textbooks, such as skipping meals (43 percent), and have made decisions about their education to accommodate the costs of course materials, such as changing majors (20 percent), taking fewer classes (30 percent), and avoiding courses with high material costs (30 percent). To afford materials almost 70 percent of students said that they took a job and 43 percent said they took out loans.

“The data is clear: high textbook costs pose barriers to students’ ability to succeed in college. Too many learners today are making painful tradeoffs between course materials and bare necessities like housing and meals,” Hansen wrote in the press release. “Our industry must embrace what students are telling us. That’s why our company has developed a new subscription model that lowers costs.”

Beginning this month, Cengage is offering students access to all of the company's digital materials, which includes more than 20,000 products, for $119.99 a semester. With this new subscription model, dubbed “Cengage Unlimited,” Hansen said that “students finally have an alternative to the traditional and costly approach of paying for each course’s materials individually.”

While textbooks are usually considered indirect costs and students receiving financial aid must use their federal aid refunds to purchase course materials, some institutions include these fees into their flat tuition rates. Western Governors University (WGU), for example, charges students a $145 “resource fee” each term to cover the cost of all of the materials they will need to complete their courses. According to the National Association of College Stores, the average price of single book in the 2015-16 academic year was $81— an increase of $22 just since 2011-12. WGU’s flat resource fee not only helps reduce costs for students, according to the university’s website, it also encourages students to enroll in more courses as the fee remains the same no matter how many credits they take.

“If you have the ability to accelerate, you can complete as many courses as you can,” Bob Collins, vice president of financial aid for WGU and Forward50 member, said. “Students are saving hundreds of dollars every term.”

That practice, however, is rare among postsecondary institutions. Other efforts taken to reduce the costs of textbooks include offering students open educational resources (OER), which are course materials such as digital textbooks that are not limited by the strict copyright laws that printed textbooks are, so they can be limitlessly duplicated and given out to students. Pioneered by the Massachusetts Institute of Technology (MIT) in 2001, several states have adopted this as a way to help cut costs for students.

For example, the University System of Maryland began offering grants in 2017 to faculty that were found to be “adopting, adapting or scaling the use of OER,” which it claimed had the potential to save more than 8,000 students $1.3 million in textbook fees in the fall semester. California appropriated $6 million to support the development and use of OER in its 2018 Budget Act, which would be in addition to several other initiatives to support online resources already in place. Additionally, just last month, New Jersey legislators introduced a set of four bills aimed at encouraging both public and private colleges to utilize OER.

Further, a new study last month by the University of Georgia found that not only did OER reduce costs for students, but it also helped to improve their grades. Comparing the grades of more than 21,000 students enrolled between 2010 and 2016, the study’s authors found that as a group, students performed better when they were given OER earlier in the semester over print textbooks. For example, it found that the number of students who received grades of D or F, or withdrew dropped by 3 percent. One reason for this, the authors wrote, was that students were more likely to use class materials when they were free.

The study specifically pointed out that Pell-eligible students were among those who greatly benefited from OER.

"A new opportunity appears to be present for institutions in higher education to consider how to leverage OER to address completion, quality, and affordability challenges, especially those institutions that have higher percentages of Pell eligible, underserved, and/or part-time students than the institution presented in this study," the authors wrote.

(Photo Credit: Cengage/Morning Consult)

Publication Date: 8/7/2018

You must be logged in to comment on this page.