Upgraded Federal Student Aid Website Includes Loan Simulator, Repayment Pilot

By Joelle Fredman, NASFAA Staff Reporter

The Department of Education (ED) completed another wave of upgrades to its federal student aid website over the weekend, which included implementing a loan simulator to help student borrowers compare repayment plans, and a pilot program to allow some to make loan payments directly through the site.

The Office of Federal Student Aid (FSA) in December debuted initial changes to StudentAid.gov that included folding the student-facing portions of StudentLoans.gov, FSAID.ed.gov, and NSLDS.ed.gov into the website, and creating a singular contact number — 1-800-4-FED-AID — for accessing all loan servicer contact centers. Over the weekend, ED completed a series of further upgrades to the student aid website, which it wrote is another step toward the Next Generation Financial Services Environment (NextGen) and in line with intentions included in President Donald Trump’s fiscal year 2021 budget proposal to simplify the student loan system.

"We're delivering on the promise of access to higher education to our nation's students and their families," FSA Chief Operating Officer Mark Brown said in a statement Monday. "We are on a journey, and today's news is just the beginning of what's to come."

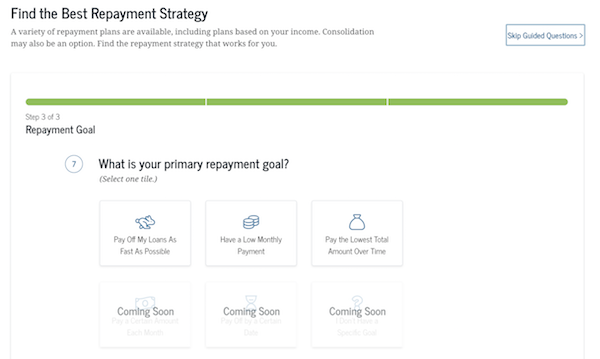

One of those upgrades, a loan simulator to replace the now-retired Repayment Estimator, combines borrower-reported information, such as their family income and makeup, and loan data from FSA to allow borrowers to "test-drive which plan provides them with the lowest monthly payment, fastest payoff term, or lowest amount paid overall." Specifically, the feature guides students down different pathways based on their responses to a question about their goals for repayment — a big improvement over its predecessor that suggested repayment schedules solely based on student data, according to Betsy Mayotte, president and founder of The Institute of Student Loan Advisors (TISLA), a non-profit group assisting students to navigate the student loan system.

"What I like about that is it shows that [ED] recognizes that all consumers are different and have different goals," Mayotte said.

In the coming months, ED wrote it plans to add more features into the simulator to allow borrowers to compare repayment options "when in financial hardship," and preview the implications of taking on more loans or returning to school.

"These new tools are an important step toward helping students understand their debt and make informed choices about repayment," said NASFAA’s Vice President of Policy and Federal Relations Megan Coval. "The ability to compare the myriad repayment plans that exist, and to make payments in a more straightforward manner is a victory for students, and we applaud ED for these improvements."

Another new feature, a pilot program to allow borrowers to make loan payments directly on StudentAid.gov, is currently accessible only to those whose federal loans are managed by Great Lakes or Nelnet, and can only be used to make scheduled payments. If a borrower currently wishes to make more than their scheduled payment, ED wrote, they must do so through the loan servicer. ED wrote that it "eventually" plans to open the program to all Direct Loan borrowers.

"Students deserve to be treated like the unique and valued customers they are," Education Secretary Betsy DeVos said in a statement. "Congress created a cumbersome and confusing web of loan and repayment options, but we continue to make great strides at FSA in providing borrowers with more detailed, personalized, and actionable information so they can take control of financing their education."

Mayotte said that while this feature helps FSA meet its goal of making StudentAid.gov a one-stop-shop for all borrowers, she feels "ambivalent" about the upgrade because she has found that many borrowers make loan payments directly from their bank accounts, and are already not visiting third-party loan servicer sites.

"I’d be curious to see how many borrowers utilize it," she said. "I think it would be useful for borrowers who don’t know who their servicers are."

The revamped StudentAid.gov also features a new dashboard detailing the different types of aid borrowers received, dubbed the "Aid Summary." ED wrote the dashboard will allow borrowers to keep track of their eligibility for Direct Loans, Pell Grants, Iraq and Afghanistan Service Grants, and number of qualifying payments toward Public Service Loan Forgiveness (PSLF).

"Sixty percent of the questions we get asked are about PSLF. Being able to easily check whenever they like where they are [in the process of qualifying for debt relief] I think is going to be a really big deal for those borrowers," Mayotte said.

ED wrote more features will be added to the website this year and will be announced in April 2020.

Publication Date: 2/25/2020

Colin B | 2/28/2020 5:55:11 PM

The system is specifically designed to allow students to make the lowest payment to increase the amount forgiven. This is not gaming the system. Forgiveness programs are designed to actually forgive some of the loans.

Ben R | 2/25/2020 9:9:13 AM

With income driven repayment and loan forgiveness, any borrowed amount is now "affordable", so the question is whether this new website will help drive responsible borrowing and lending in the traditional sense - borrowing only what you can afford to pay back in full - or, will it make borrowers oblivious to the amount they take on and teach them to game the system?

You must be logged in to comment on this page.