Study Examines Psychological Costs of Early Financial Distress in College

By Mandy Sponholtz, Policy & Federal Relations Staff

The Minority College Cohort Study recently released the first of three reports discussing the psychological costs of going to college. The study will follow black and Latino students who are “academically prepared and educationally motivated” and enrolled in one of five Illinois schools during fall 2013. The study will continue through spring 2019.

This first report looks at financial distress, which the authors describe as the “students’ perception of the adequacy of their finances rather than the actual amount of debt and unmet need—and its effects on student well-being via diminished feelings of belonging and commitment to educational goals, heightened doubt about the benefits of college, and stress and depression.”

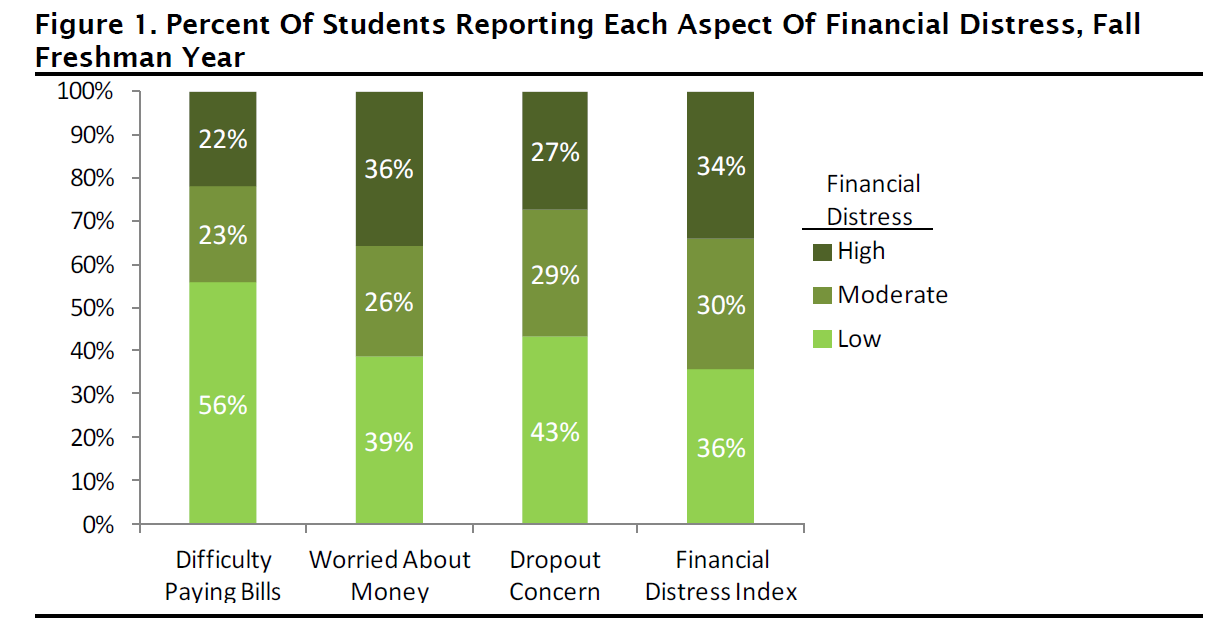

The study found that the majority of black and Latino students do not start college with financial distress:

Image provided from p. 6 of the report.

Of the students that did report a high level of financial distress, the respondents fell into three groups:

- Students who enrolled knowing there was an unmet financial need, but hoped they could find the means to pay the balance before it affected future enrollment.

- Students who enrolled believing there was no unmet need, but an aid amount that was lower than expected or changes to housing or other areas resulted in unmet need.

- Students who enrolled believing that financial aid would cover all necessary costs, but did not budget for living expenses.

When students do not have enough money, 75 percent reported making “at least one financial adjustment,” such as reducing unnecessary expenditures or using a credit card, to cover expenses. This figure includes students with low levels of financial distress. Students with high levels of financial distress reported making multiple adjustments at the same time.

The study also found that for students who begin college with a high level of financial distress, nearly half remain in that state if they return for a second year. Of the students with moderate levels of financial distress, about 40 percent move down to a low level and 25 percent move up to a high level upon returning for their sophomore year.

The authors state, “Consistent with existing research, the interviews revealed that many students are not fully aware of the amount of their financial aid, what amounts are grants versus loans, the interest rates, or the academic conditions of their financial aid.”

However, the type of aid may make a difference in a student’s perceived financial distress. Students with loans were more than twice as likely to report a high level of financial distress as those without any loans. The study “tested the effect of the presence or absence of each specific type of funding, and the psychological benefit appears to come from being able to finance college without loans.”

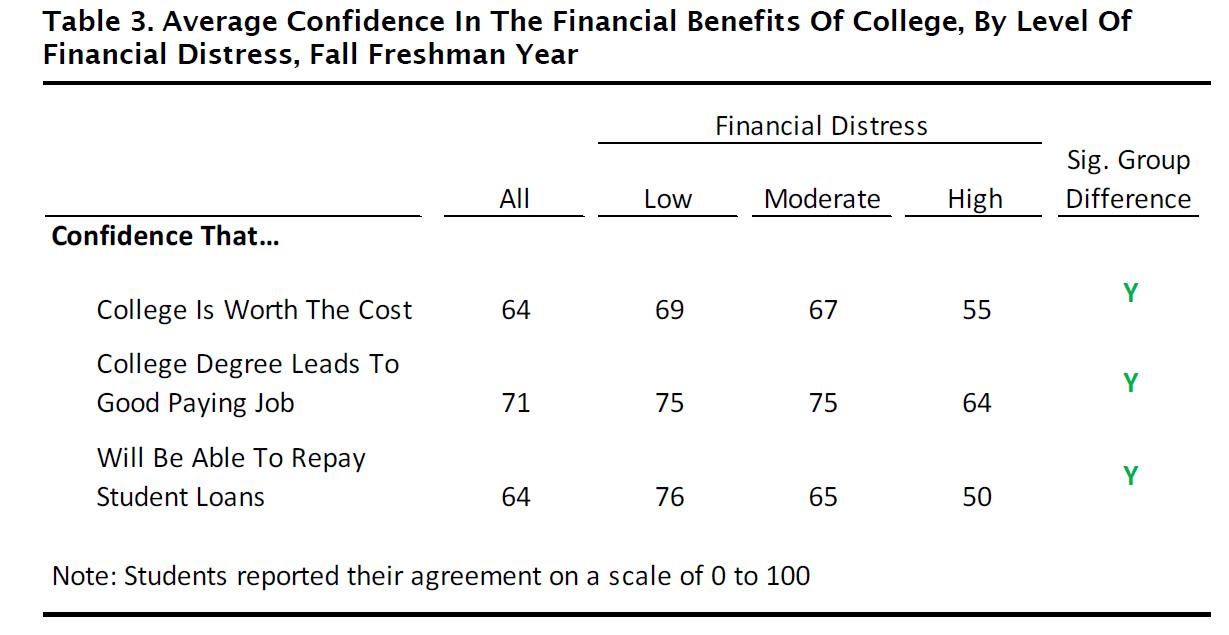

Financial distress also affects a student’s perception of the benefits of a college education:

Image provided from p. 18 of the report.

Students with high amounts financial distress also reported higher rates of depressive symptoms between the fall and spring terms, which also was associated with the documented drop in GPA for these students.

The report concludes that “the high financial and psychological costs of college reduce the likelihood that academically prepared students will persist through to degree attainment.” The authors urge schools to better understand financial distress after enrollment and take steps to increase institutional transparency regarding price, financial aid and the value of college.

Publication Date: 9/15/2015

You must be logged in to comment on this page.