Issue Brief: Student Loan Repayment

May 2021

Key Takeaways

- As of September 2019, approximately $1.5 trillion in outstanding federal student loan debt was held by approximately 43 million borrowers.1

- There are over 50 federal loan forgiveness and loan repayment programs currently authorized, with at least 30 operational as of Oct. 1, 2017.2 Of these, there are eight widely-available repayment plans, including five income-driven repayment plans. This creates a great deal of complexity for borrowers seeking to navigate the variety of loan repayment options.

- Through the Higher Education Act (HEA) reauthorization, Congress has several opportunities to improve and simplify student loan repayment for borrowers. To address the challenges students face when repaying their loans, Congress should simplify the existing federal loan repayment plans, strengthen Public Service Loan Forgiveness, eliminate loan origination fees, and ensure the Department of Education works to smoothly transition borrowers back into repayment after the COVID-19-related pause on payment, interest, and collections has ended.

The Student Loan Repayment System

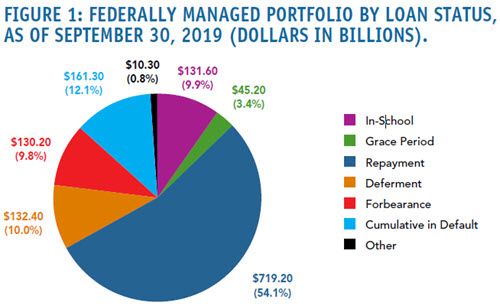

As of September 2019, approximately $1.5 trillion in outstanding federal student loan debt was held by approximately 43 million borrowers.3 Approximately $982 billion of outstanding federally-managed loans — which include Federal Direct Loans and Federal Family Education Loan (FFEL) program loans held by the Department of Education (ED) — had entered repayment but were not in default. Of this amount, as seen in Figure 1, $132 billion was in deferment, $130 billion was in forbearance, and $719 billion was in active repayment.4 Nearly $132 billion of Federal Direct and ED-held FFEL loans were held by borrowers still in school, $45 billion were held by those in their post-graduation grace period, and another $161 billion were in default.5 It is important to note that these figures were reported prior to the onset of the COVID-19 pandemic and the pause in student loan repayment that began in March 2020.

Source: "Federal Student Loan Portfolio," Federal Student Aid, (https://studentaid.gov/data-center/student/portfolio). Portfolio by Loan Status, Q4 2019. Reflects data for Federal Direct Loans and Federal Family Education Loan (FFEL) program loans held by ED as of September 30, 2019.

While students are enrolled, they are not required to make any payments on their outstanding federal student loan balance. After graduation, borrowers are given a six-month grace period before they enter repayment. At the end of the grace period, borrowers enter repayment and must begin making monthly payments on their loans. ED contracts with student loan servicers to carry out much of the day-to-day operations of student loan repayment for the more than 30 million borrowers with Federal Direct Loans and FFEL loans held by ED.6 Loan servicers are the primary point of contact between borrowers and the federal government once a student borrower leaves school. To manage loans, servicers place and receive millions of phone calls, emails, and items of postal mail to ensure students understand their repayment obligations and the various plans available.

A Closer Look at Student Loan Repayment

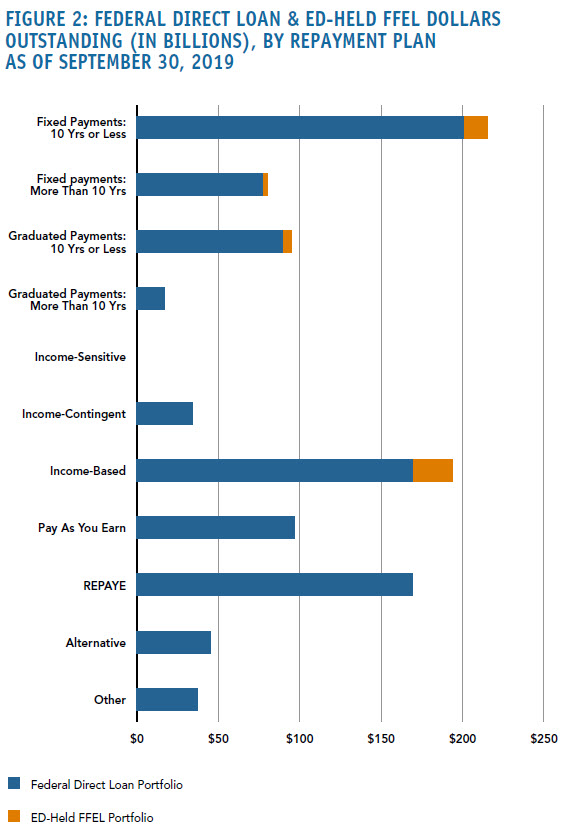

According to the Congressional Research Service, there are over 50 loan forgiveness and loan repayment programs currently authorized, with at least 30 operational as of Oct. 1, 2017.7 Borrowers, based on a variety of eligibility factors, can elect repayment plans with fixed or graduated payments for up to 10 or 30 years, or choose to enroll in one of several income-driven repayment (IDR) plans. Income-contingent repayment (ICR), income-based repayment (IBR), income-sensitive repayment (ISR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) are each IDR plans with differing requirements for eligibility, monthly payments, and income verification. (See Table 1 & Figure 2).

Table 1: Federal Student Loan Repayment Plans

Plan |

Payments |

Timeframe |

|

Standard Repayment Plan |

Fixed |

10 years |

|

Graduated Repayment Plan |

Lower at first then gradually increase, usually every two years |

10 years |

|

Extended Repayment Plan |

Fixed or graduated |

25 years |

|

Revised Pay As You Earn Repayment Plan (REPAYE) |

10% of discretionary income, recalculated annually and based on updated income and family size |

Forgiven after 20 years (if all loans were for undergraduate study) or 25 years (for graduate or professional study) |

|

Pay As You Earn Repayment Plan (PAYE) |

10% of discretionary income, recalculated annually and based on updated income and family size; never more than standard repayment plan payments |

Forgiven after 20 years |

|

Income-Based Repayment Plan (IBR) |

Either 10% or 15% of discretionary income, depending on when loans were first received; never more than standard repayment plan payments |

Forgiven after 20 or 25 years, depending on when loans were first received |

|

Income-Contingent Repayment Plan (ICR) |

The lesser of either 20% of discretionary income or the payment amount of a fixed plan over 12 years, adjusted according to income; recalculated annually and based on updated income, family size, and total amount of direct loans |

Forgiven after 25 years |

|

Income-Sensitive Repayment Plan (ISR) |

Based on annual income |

15 years |

|

Public Service Loan Forgiveness (PSLF) |

Must be employed by a U.S. federal, state, local, or tribal government or not-for-profit organization working full time. Pay Direct loans through an income-driven repayment plan. |

120 payments |

Source: https://studentaid.gov/manage-loans/repayment/plans

Source: "Federal Student Loan Portfolio," Federal Student Aid, (https://studentaid.gov/data-center/student/portfolio). Portfolio by Repayment Plan, Q4 2019. Reflects data for Federal Direct Loans and Federal Family Education Loan (FFEL) program loans held by ED as of September 30, 2019.

Challenges Students Face

The repayment benefits and protections of the federal student loan programs are generally quite generous, however multiple changes and tweaks over the years have created a tangled web of repayment options that can confuse borrowers. Because of this complexity, many borrowers who could benefit from certain repayment plans, like income-driven repayment, may never enroll because they are unable to compare and navigate these plans effectively.

The myriad repayment plans make it difficult for schools and loan servicers to communicate options to borrowers. Improvements to loan servicing are also needed to ensure borrowers have the information they need to be able to repay their loans without sacrificing their financial well-being. Borrowers do not choose their servicer, ED assigns them one with the expectation that all servicers are equally capable in serving borrowers. However, the Government Accountability Office (GAO) has identified weaknesses in ED's oversight of servicers' ability to provide quality customer service and maintain program integrity,8 and NASFAA found a lack of consistency in servicers' practices, as well as in how they communicated with students.9 Rising public criticism of loan servicers and the standards by which they are evaluated also led the House Financial Services Committee to hold a hearing to examine student loan servicer accountability in September 2019.10

Many borrowers in income-driven repayment plans expect to ultimately benefit from the Public Service Loan Forgiveness (PSLF) program. Congress created the PSLF program in 2007, with the goal of encouraging borrowers to pursue careers in public service in exchange for the opportunity for loan forgiveness after 120 consecutive payments. However, a GAO analysis published in 2018 after the first cohort of PSLF candidates became eligible to apply for forgiveness found ED's PSLF servicer had denied approximately 99% of applicants for PSLF during the first eight months.11 Although most applicants were denied as a result of not meeting at least one of the program requirements, many argue the program's challenges were inevitable given the complex nature of the eligibility requirements that Congress established when it designed the program. As borrowers struggle to navigate PSLF, and loan servicers and ED disagree over where responsibility lies for oversight and administration of the program, borrowers, consumer advocates, lawmakers, and federal officials have pointed fingers for what most have described as a failed implementation. In September 2019, the House Committee on Education and Labor held a hearing examining the PSLF program,12 during which NASFAA submitted testimony outlining concerns with the implementation of PSLF and providing recommendations to improve implementation moving forward.13

What Congress Can Do

NASFAA urges Congress to take the following actions to curb unnecessary student indebtedness and simplify the current repayment system. Building off of these recommendations, NASFAA, using grant funding, will continue its ongoing efforts to develop additional, detailed policy solutions to ensure the repayment system works for all borrowers.

- Ensure a smooth transition to repayment after the COVID-19 pause ends.

On March 20, 2020, ED announced that student loan payments, interest, and collections would be halted in order to provide relief for the COVID-19 pandemic.14 This relief has been extended twice and currently goes through September 30, 2021. When the COVID-19-related pause on payments, interest, and collections ends, millions of borrowers will move back into repayment simultaneously. Congress should ensure that ED immediately begins work with borrowers and servicers to facilitate a smooth transition, when the time comes, back into repayment for the nearly $40 million Americans with federal student loan debt.15 - Ensure smooth and timely implementation of the FUTURE Act.

The 2019 Fostering Undergraduate Talent by Unlocking Resources for Education (FUTURE) Act allows for direct data sharing between ED and the Internal Revenue Service (IRS), which will simplify and streamline the process of income-driven repayment enrollment and recertification. Once implemented, the FUTURE Act will allow borrowers to give the IRS permission to share certain limited tax information with ED in order to determine eligibility for IDR plans and monthly payment amounts. We urge Congress to ensure that ED works with stakeholders to implement the FUTURE Act provisions related to IDR enrollment and recertification as quickly as possible. - Consolidate and simplify the federal loan repayment plans.

Consolidating the various repayment plans into a single income-driven repayment plan and a single standard repayment plan will help borrowers understand the benefits and protections inherent in our federal student loan repayment system. The consolidated IDR plan should be easy to enroll in and include generous terms and conditions that provide struggling borrowers with the safety net they need to remain in good standing during economically challenging times. These programs should be made available to all existing borrowers as well as prospective borrowers. - Strengthen Public Service Loan Forgiveness.

PSLF encourages students to pursue and commit to vital public service careers without fear that their student loan payments will follow them for decades. The program is of high value to both students and society, but needs to be evaluated and strengthened in order to ensure it is the most efficient, simple, fair program for borrowers working in public service. Improvements to the program may include, for example, the concept of rolling forgiveness rather than one-time forgiveness at the end of the 10-year period. With regard to implementation, the effectiveness of PSLF could be improved by strongly encouraging the submission of annual employment certification forms and emphasizing increased outreach to borrowers about the program. Additionally, Congress should encourage ED to provide more publicly-available data about the PSLF program's cost, effectiveness, and integrity. - Eliminate student loan origination fees.

A relic of bank-based lending, student loan origination fees have been deemed the "student loan tax" because they withhold a portion of a student's and parent's loan proceeds while still requiring repayment with accrued interest of the full loan amount before the deduction of fees. These fees mask the borrower's true loan cost and compound the confusion surrounding federal student loans. Under mandatory sequestration, loan fees are increased based on an annual adjustment percentage determined by the Office of Management and Budget (OMB). Though origination fees serve as a revenue generator for the federal government, the federal budget should not be balanced on the backs of students and families. - Restore graduate and professional student eligibility for subsidized loans.

Undergraduate students with demonstrated financial need are eligible for Federal Direct Subsidized Loans. Eligible students do not accrue any interest on their subsidized loans during the time that they are enrolled at their institutions at least half-time, but the Budget Control Act of 2011 eliminated graduate student eligibility for the in-school interest subsidy as a means of reducing the federal budget deficit. With no access to federal grants, the elimination of the in-school interest subsidy harms low-income students in their pursuit of an advanced degree and leads to increased debt. Benefits for graduate and professional students are often the first targeted in the federal budget process, which leads to higher debt loads and a growing utilization of private loans with inconsistent consumer protections. - Provide financial aid offices with more tools to curb student indebtedness.

As it stands now, institutions have little control over the borrowing behavior of their students. Financial aid administrators want to be good stewards of federal funds, but more importantly, they want to ensure their students avoid accruing unnecessary or excessive debt and are able to repay their loans. Because of the entitlement nature of the Direct Loan Program, a school cannot impose across-the-board restrictions on borrowing institution-wide, or even by program, enrollment status, dependency status, or any other parameters. Furthermore, institutions do not have the authority to require additional loan counseling or documentation supporting a request for loan funds. Providing institutional authority to mandate additional counseling allows institutions to tailor counseling requirements to the unique characteristics of their students, instead of having to comply with a one-size-fits-all annual counseling federal mandate. By enhancing institutions' authority to limit borrowing based on reasonable parameters and require additional counseling, schools can better serve their students. - Increase front-end investment by doubling the maximum Pell Grant.

It is equally critical that Congress provide robust front-end investment in the federal student aid programs to ensure that students, especially those who are low-income, have the necessary resources to succeed in higher education. Congress should double the maximum Pell Grant to limit the amount of debt that low-income students must take on to access college.

Additional Proposals to Consider

In addition to these recommendations for reforms, there are a number of other proposals that merit consideration and further research, as Congress and the Biden administration work to improve the student loan system and help struggling borrowers.

- Eliminate Negative Amortization.

IDR plans exist to provide struggling borrowers with a safety net during times of economic distress. Borrowers enrolled in IDR who are making on-time monthly payments should not see their overall balance increase each month. The notion of borrowers having larger debts in the middle of repayment than when they began, despite making their required monthly payments, is both demoralizing to borrowers and counterintuitive to the purpose of IDR plans. - Consider automatically enrolling delinquent borrowers in IDR plans.

IDR, especially once reformed as NASFAA has proposed, provides borrowers with a student loan payment amount that is intended to be affordable based on income and family size. IDR offers struggling borrowers a path to remain in good status by adjusting monthly payments to an affordable amount, sometimes as little as $0 per month. To ensure those most in need of IDR are able to easily access its inherent protections, delinquent borrowers could be automatically enrolled in IDR based on their income and tax returns. - Explore targeted debt forgiveness.

The more than $1.5 trillion in outstanding student loan debt impacts Americans' ability to plan for their financial futures, such as saving for retirement or investing in a home. In addition to doubling the Pell Grant and providing robust investment in other federal student aid programs, Congress could explore debt forgiveness that is targeted to borrowers with the greatest financial need, and those who struggle most to repay their loans, to ensure that a college degree leads to financial self-reliance and not a life of penury.

1 "Federal Student Loan Portfolio," Federal Student Aid, (https://studentaid.gov/data-center/student/portfolio). These estimates reflect outstanding debt and borrowers for loans in the Federal Direct Loan program and all loans in the Federal Family Education Loan (FFEL) program.

2 "Federal Student Loan Forgiveness and Repayment Programs," Congressional Research Service, (https://fas.org/sgp/crs/misc/R43571.pdf).

3 "Federal Student Loan Portfolio," Federal Student Aid, (https://studentaid.gov/data-center/student/portfolio). These estimates reflect outstanding debt and borrowers for loans in the Federal Direct Loan program and all loans in the Federal Family Education Loan (FFEL) program.

4 See Figure 1.

5 See Figure 1.

6 "Who's My Student Loan Servicer?" Federal Student Aid, (https://studentaid.gov/manage-loans/repayment/servicers).

7 "Federal Student Loan Forgiveness and Repayment Programs," Congressional Research Service, (https://fas.org/sgp/crs/misc/R43571.pdf).

8 https://www.gao.gov/products/GAO-18-587R

9 https://www.nasfaa.org/Servicing_Issues

10 https://financialservices.house.gov/calendar/eventsingle.aspx?EventID=404230

11 https://www.gao.gov/products/gao-18-547

12 https://edlabor.house.gov/hearings/broken-promises-examining-the-failed-implementation-of-the-public-service-loan-forgiveness-program

13 https://www.nasfaa.org/uploads/documents/NASFAA_Hearing_Letter_on_PSLF.pdf

14 https://studentaid.gov/announcements-events/coronavirus

15 https://www.nasfaa.org/uploads/documents/Memo_Transitioning_Borrowers_Repayment.pdf

Publication Date: 5/6/2021