Part 2: GE Regulations Deep Dive: Lessons Learned and Future Challenges

By Abbie Barondess, NASFAA Policy Staff

Editor's Note: This is the second in a series of three articles examining Gainful Employment (GE) regulations. This first article provides an overview and brief timeline of GE. This article covers the 2014 GE regulations, lessons learned, and challenges to GE moving forward. The third article will provide an update on the current GE proposal, projected impacts, and NASFAA’s recommendations.

In 2014 the Obama administration set out to regulate GE for the second time. In place of a loan repayment rate, which was the basis of the litigation surrounding the 2011 rule, ED proposed a program cohort default rate (pCDR), which encapsulated both program completers and non-completers who received Title IV aid. The debt-to-earnings ratio (D/E metric) issued under the 2011 regulation, which applied only to program completers who received Title IV aid, remained in place. To pass, programs would have to have had a pCDR of less than 30%. Programs with a pCDR of 30% or higher in three consecutive cohorts failed the metric and lost Title IV eligibility. Program cohort default rates were removed from the final rule following comments from the American Association of Community Colleges and Association of Community College Trustees. The final rule was published on October 31, 2015, with an effective date of July 31, 2015.

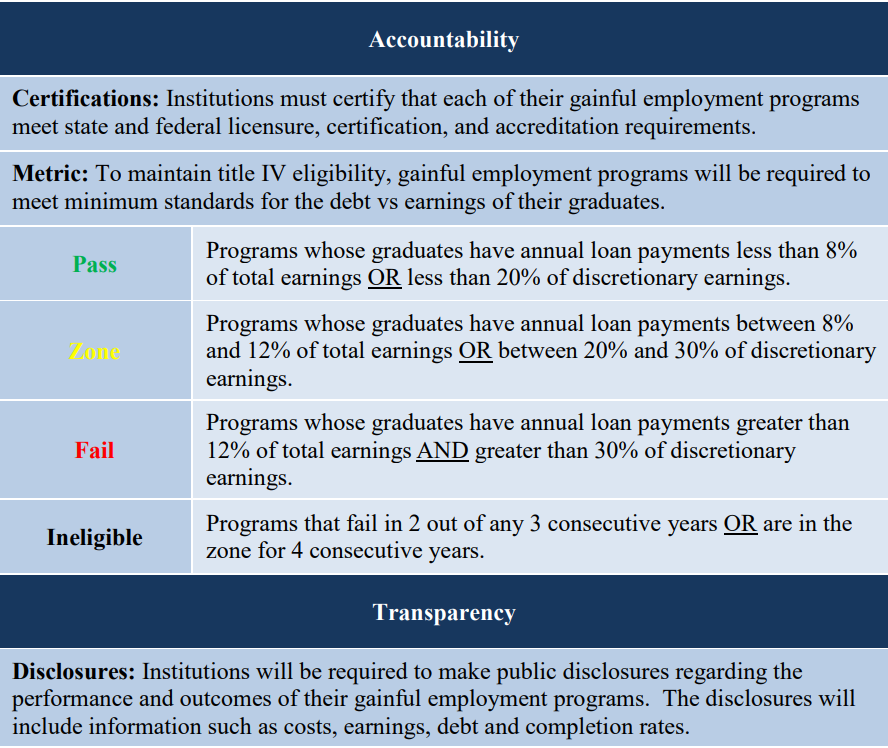

The chart below details the D/E thresholds that were included in the final rule. The rule established a third determination, the “zone,” that softened the D/E cutoffs that identified a program as failing. Additionally, the rule required programs to disclose to students if they were at risk of losing Title IV eligibility.

*Title IV completers only

Shaping the Final Rule

Colleges and universities, as well as NASFAA, expressed concern over the implementation timeline and administrative burden associated with the 2014 final rule. Institutions were required to report program data back to the 2008-09 year by July 31, 2015, less than a month after the regulation went into effect. NASFAA urged ED to delay implementation by six months in order to ensure accuracy, and give institutions more concrete guidance on reporting requirements.

Leading up to the final regulation, ED received 95,000 comments in response to the proposed regulation. Comments fell on both sides of the spectrum, with some opposing the rule altogether and others pressing for a stronger rule.

-

The HEA does not support ED’s regulatory action in defining gainful employment and, even if ED has the authority, GE should be addressed through HEA reauthorization or legislation.

-

Using a single D/E metric did not accurately differentiate between high and low-quality programs.

-

The pCDR metric is inapplicable to programs with a small number of student borrowers.

-

The regulations would sanction programs that serve large populations of low-income, veteran students, and students of color, leading to decreased access for these groups. These institutions are often less-resourced and will have fewer institutional dollars to give students in the absence of Title IV funds.

-

There is not enough data to identify proper sanctions.

-

The regulations promote liberal arts and humanities programs at the expense of necessary workforce development programs at community colleges and proprietary schools.

-

ED’s inability to define “gainful employment” has led to overly complex and piecemeal regulations that have placed significant administrative burdens on institutions without evidence to show students have benefited.

-

The regulations may incentivize institutions to admit fewer “at risk” students to increase their outcomes. Additionally, institutions can evade sanctions by limiting program size.

-

GE regulations only look at earnings from graduates, potentially leading to programs with low D/E ratios but high dropout rates to avoid sanctions.

-

Financial relief should be provided to students enrolled in programs that lose Title IV eligibility, and students in these programs should not be responsible for loan repayment.

-

The pCDR metric does not eliminate the need for a repayment rate metric. Many programs that pass the pCDR and D/E threshold have low repayment rates, leaving students with a higher likelihood of default.

The 2014 GE Rule issued under the Obama administration was in effect for one year due to numerous implementation delays, not long enough for any programs to face sanctions. In 2019, then Secretary of Education, Betsy DeVos, announced its repeal, effective July of 2020. ED cited several concerns over the 2014 rule, and said in their proposed rule that:

“The department has determined that the GE regulations rely on a debt-to-earnings (D/E) rates formula that is fundamentally flawed and inconsistent with the requirements of currently available student loan repayment programs, fails to properly account for factors other than institutional or program quality that directly influence student earnings and other outcomes, fails to provide transparency regarding program-level debt and earnings outcomes for all academic programs, and wrongfully targets some academic programs and institutions while ignoring other programs that may result in lesser outcomes and higher student debt.”

In place of GE regulations, the ED opted for the College Scorecard as a federal accountability tool. Below is a non-exhaustive summary of ED’s reasoning for rescinding the 2014 GE regulations.

-

All programs at for-profit institutions were subject to the regulations, while only 16% of the GE programs at non-profit institutions were large enough to be subject to the regulations' D/E calculations and reporting requirements.

-

The D/E rates were inconsistent with availability of repayment options such as IDR.

-

The GE regulations unfairly target proprietary institutions because the D/E rates did not include the total cost of education relative to graduate earnings.

-

The 8% D/E threshold used to determine a program's status as “passing”, “zone”, and “failing” was arbitrary and lacked empirical support.

-

Reporting requirements such as job placement rates are unreliable and do not provide the necessary information for students to make informed higher education choices.

-

The GE regulations lacked utility because they did not apply to all Title IV programs. ED could not expand the regulations because “gainful employment” is only found in section 102 of the HEA, applying to non-degree programs and non-profits and all programs at for-profit institutions. In order to improve the accuracy and reach of GE regulations, students needed to be able to compare GE and non-GE program outcomes.

-

The regulation does not account for socioeconomic and demographic differences across programs and institutions that lead to worse outcomes. Sanctions unfairly target these programs and limit opportunities for non-traditional students.

-

The College Scorecard served as a better tool for improving transparency. Changes made to the scorecard allowed students to compare debt and earnings data across all Title IV institutions.

As the Trump administration pressed forward with repealing the Obama-era GE regulations, many advocacy organizations expressed concerns, both substantive and procedural, over ED’s de-regulation of the for-profit industry. Additionally, many higher education institutions who had expressed concern over the rule’s administrative burden favored tweaking the rules rather than repealing them all together.

Who Should Be Included in the D/E Calculation?

Under the 2014 regulation, the D/E calculation used the median annual loan payments of all students in the program (borrowers and non-borrowers), who receive Title IV funds. Students who had only Title IV grants, such as Pell, were assigned a loan amount of zero and included in the calculation. Using this calculation the D/E metric is heavily influenced by the number of borrowers, and programs with fewer borrowers will have lower median loan amounts, leading them to “pass” more often. Under this formula, a program in which less than half the Title IV aid recipients have debt automatically passes the D/E threshold as the median value of their debt payments is zero. While programs should be rewarded for having fewer students who take on debt, this calculation may give an inaccurate picture of how affordable debt is for students who do borrow. On the flip side, a D/E calculation that only includes borrowers may understate the program’s return on investment as it only represents outcomes for the share of graduates who borrowed.

Additionally, questions remain over the types of loans that should be included in the D/E calculation. Including only loans borrowed for tuition will underestimate programs’ debt burden, as students often borrow significant amounts for housing and other living expenses. However, institutions have little control over non-tuition related expenses or borrowing, and it may be unfair to hold them accountable for these types of borrowing. In addition, ED will need to consider the inclusion of private, institutional, and parent loans. In excluding these types of loans, the regulation runs the risk of institutions guiding students to loans not covered in the rule. GE regulations will need to consider these tradeoffs and find a balance between student utility and institutional feasibility.

The next blog will detail the current GE proposal, projected impacts, concerns, and NASFAA’s recommendations.

Publication Date: 9/11/2023

You must be logged in to comment on this page.