Issue Brief: Doubling the Maximum Pell Grant

Originally published in June 2021; Updated in August 2022

Key Takeaways

- The Pell Grant is the cornerstone of the federal student aid programs, providing need-based grant aid to our country's lowest-income postsecondary students.

- Pell Grants have failed for decades to keep pace with increased college costs and inflation.

- Doubling the maximum Pell Grant to $13,000 will effectively recalibrate the grant and restore its purchasing power.

- The lowest-income students will benefit the most from doubling the maximum Pell Grant, but eligibility would also expand to moderate-income students, for whom affording college is also a struggle.

Program Background

The federal Pell Grant program is the "foundational" federal student aid program. The program provides grants to undergraduate students with financial need who have not yet earned their first bachelor's degree, to help pay the costs of attending a postsecondary institution. During the annual congressional appropriations process, the minimum and maximum Pell Grant award levels are established for the upcoming award year. During the 2021-22 award year, Pell Grants ranged from $650 to $6,495.1 In award year 2022-23, Pell Grant amounts will range from $692 to $6,895.2 The Pell Grant amount students receive is based on their institution's cost of attendance and family's financial need, and schools must determine a student's Pell Grant eligibility before calculating eligibility for other federal student aid programs.

In the 2020-21 award year, approximately 6.4 million students received a Pell Grant. During the same year, the average grant amount received was $4,166, and total federal expenditures for the program totaled $26.5 billion.3 The vast majority of Pell Grant recipients come from low-income backgrounds, with just over 78% of recipients during the 2019-20 award year having a family income of less than $40,000 (see Table 1).

Table 1: Number and Distribution of Pell Grant Recipients by Family Income Level, Award Year 2019-20

| Family Income Level | Number | Percentage |

| $6,000 or less | 1,337,464 | 19.83% |

| $6,001 to $15,000 | 1,184,814 | 17.56% |

| $15,001 to $20,000 | 733,285 | 10.87% |

| $20,001 to $30,000 | 1,175,984 | 17.43% |

| $30,001 to $40,000 | 832,607 | 12.34% |

| $40,001 to $50,000 | 616,537 | 9.14% |

| $50,001 to $60,000 | 426,520 | 6.32% |

| $60,001 and over | 438,949 | 6.51% |

| Total | 6,746,160 | 100% |

Source: U.S. Department of Education, Federal Pell Grant Program End-of-year Report, 2019-2020.

The Pell Grant program is especially critical to supporting postsecondary access for other historically underrepresented student populations beyond low-income students (see Table 2). Students of color are more likely to be Pell Grant recipients, with nearly 60% of Black students and roughly half of American Indian/Alaska Native and Hispanic students receiving a grant each year, compared with just under one-third of white students. Additionally, roughly half of first-generation college students and student parents, and almost 40% of student veterans, are Pell Grant recipients.4

Table 2: Percentage of Students Receiving Pell Grants by Demographic, Academic Year 2015-16

| Student Demographic | Percent Receiving Pell |

| African American | 58% |

| Hispanic / Latinx | 47% |

| American Indian / Alaska Native | 51% |

| White | 32% |

| First Generation | 48% |

| Student Parents | 52% |

| Student Veterans | 39% |

Source: U.S. Department of Education, National Center for Education Statistics, 2015-16 National Postsecondary Student Aid Study (NPSAS:16).

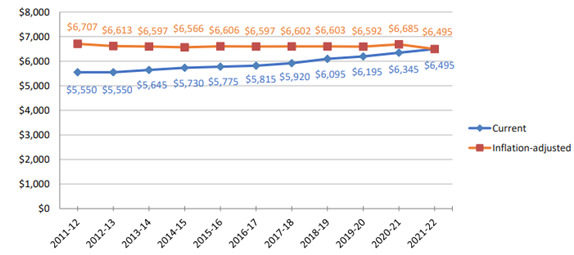

The issue of college affordability in the context of student loan debt has received ever-increasing attention from the media and Congress, yet today's maximum Pell Grant award remains at a level similar to fiscal year (FY) 1978, when adjusting for inflation.5 From FY 2014 to FY 2017, the Pell Grant maximum award was indexed to the Consumer Price Index for All Urban Consumers (CPI-U); however, that small boost, which averaged only $69 per year, expired at the end of FY 2017. Since then, Congress has passed small increases to the maximum award as part of the annual appropriations process, but even with these increases, the maximum award has failed to keep up with inflation (see Figure 1).

Figure 1: Maximum Pell Grant Award in Current and Inflation-Adjusted Dollars, 2011-12 to 2021-22

Source: U.S. Department of Education, Federal Pell Grant Program End-of-year Report, 2019-2020; FSA data from website, 2022. Inflation-adjusted to 2021 dollars calculated by NASFAA, using the Consumer Price Index (CPI-U) for the July beginning of the academic year.

In addition to being outpaced by inflation, the maximum Pell Grant amount has failed to keep pace with increases in college costs (see Table 3). The 2020-21 maximum Pell Grant of $6,4956 covered only 26% of the average cost of attendance at a public four-year institution,7 while the maximum grant in 1975-76 covered more than three-quarters of the cost of attending a public four-year institution.8 Although the small increases passed by Congress each year have been helpful in providing an upward momentum for the program, Congress should double the maximum Pell Grant, a proposal that is long overdue and which has been supported by many in the higher education community. This front-end investment in college affordability will take an important first step toward restoring the Pell Grant to its original purchasing power and ensure more equitable access to postsecondary education for all Americans.

Table 3. Share of College Expenses Covered by 2021-22 Maximum Pell Grant & Doubled Maximum Pell Grant

| Sector (living arrangement) | Total Cost of Attendance (COA) | Percent of COA Covered by 2020-21 Maximum Pell Grant | Percent of COA Covered by Maximum Pell Grant if Doubled to $13,000 |

| Public 2-year (in-state, living off campus not with family) | $20,803 | 31.2% | 62.5% |

| Public 2-year (in-state, living off campus with family) | $11,320 | 57.4% | 114.9% |

| Public 4-year (in-state, living on campus) | $25,048 | 25.9% | 51.9% |

| Private 4-year (living on campus) | $43,873 | 14.8% | 29.6% |

Notes: Cost of attendance data reflects averages costs during the 2019-20 academic year. Analysis uses Integrated Postsecondary Education Data System (IPEDS) data on student charges for the 2019-20 academic year, and the 2021-22 maximum Pell Grant of $6,495. Within IPEDS approximately 190 schools are classified as four-year institutions even though they primarily award associate degrees. This table classifies those schools as two year institutions.

Doubling the Maximum Pell Grant: A Necessary Investment

Doubling the maximum Pell Grant to $13,000 would increase the grant amounts received by current recipients. Current recipients of the maximum Pell Grant — those with an expected family contribution (EFC) of zero — would see their grant double. All other current recipients (those who receive a grant amount less than the maximum) would receive a Pell Grant award increase of the same dollar amount as the increase received by maximum award recipients. Doubling the maximum Pell Grant to $13,000 would also expand the EFC range that qualifies students for Pell, in turn extending eligibility to some additional, moderate-income students who do not currently qualify for the grant.

Along with doubling the maximum Pell Grant to $13,000, NASFAA recommends lawmakers consider enacting a minimum Pell Grant award of 5% of the maximum award (rather than the current 10%). This would allow students who qualify for at least 5% of the maximum award to receive a grant, maintaining the minimum award closer to its current level and removing the possibility of a steep eligibility cliff for students whose EFCs fall just outside of the Pell-eligible range.

While costly, doubling the Pell Grant simply makes up for necessary investments in federal student aid that have been pushed off for decades. And, unlike broad-scale debt forgiveness, doubling the Pell Grant is targeted to students with the greatest need, and represents a sustainable, front-end, and long-term solution to college access and affordability issues impacting lower-income students.

The Pell Grant program's discretionary funding, which funds the majority of each year's maximum award, has been relatively flat and has not seen an increase in a number of years. Appropriators are unlikely to have room in their budget allocation each year to cover the cost of this double Pell approach through discretionary increases alone. Consequently, program investments of this nature will likely require mandatory investments. NASFAA has long supported transitioning the Pell Grant program to fully mandatory funding to align its structure with how it operates — as an entitlement.

What Congress Can Do

- Congress should re-commit to the original intent of the Pell Grant program by doubling the maximum grant amount to $13,000 to restore its purchasing power for low- and moderate-income students struggling to meet college costs.

- Congress should restore the 5% minimum Pell award, as was in place prior to the Higher Education Opportunity Act of 2008, to smooth out steep eligibility cliffs that would result from doubling the Pell Grant.

- Congress should transition the Pell Grant program to fully mandatory funding, and reinstate the automatic inflation adjustment to the maximum award to ensure the grant maintains its purchasing power over time.

1 Federal Pell Grant Payment and Disbursement Schedules, 2021-2022 Award Year

2 Federal Pell Grant Payment and Disbursement Schedules, 2022-2023 Award Year

3 U.S. Department of Education, Federal Student Aid Data Center, Title IV Program Volume Reports, 2020-2021 Award Year Grant Volume by School.

4 See Table 2.

5 "Trends in Student Aid, 2019" The College Board

6 https://fsapartners.ed.gov/knowledge-center/library/dear-colleague-letters/2021-01-22/2021-2022-federal-pell-grant-payment-and-disbursement-schedules

7 See Table 3.

8 2019 Digest of Education Statistics.

Publication Date: 8/23/2022