Department of Education Moves Forward on Mobile Feature for Title IV Credit Balances

By Joelle Fredman, NASFAA Staff Reporter

The Department of Education (ED) published a solicitation today for companies to develop a pilot program to help students receive their Title IV credit balances without any fees via a mobile app—the latest step in ED’s implementation of its “Next Generation Financial Services Environment.”

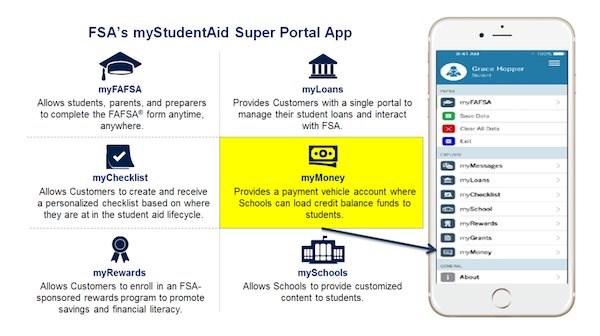

ED wrote in a notice in the Federal Register that the pilot program, first introduced almost one year ago by Dr. A. Wayne Johnson, the former chief operating officer of the Office of Federal Student Aid (FSA), will be integrated into FSA’s myStudentAid mobile app, which also hosts the mobile FAFSA released this past summer. The program, which ED explained will appear as a feature dubbed “myMoney,” may also “be used to conduct other transactions through both a physical and virtual card,” in addition to disseminating Title IV credit balances.

“Eligible colleges and universities receive FSA student financial aid funds directly from the Department and then apply these funds to student accounts to cover the cost of tuition and fees,” ED wrote. “These schools are required to provide the credit balance funds to students in a transparent, timely, and cost-effective manner, at least parts of which are at no cost to the student. This pilot would be a completely no-cost solution for participating customers.”

ED announced last January that it would begin soliciting companies to manage a pilot of what it called the “FSA Payment Card Program” to be hosted in the existing app. The current solicitation, which refers to the program as a “Payment Vehicle Account,” asked companies to enter into “cooperative agreements” with ED, in which they will not receive any payment for running the pilot program. ED also wrote that companies will not be allowed to charge schools for the service.

“The Department has determined that a cooperative agreement is the appropriate vehicle for this pilot, because FSA is not acquiring property or services for the direct benefit or use of the Government,” according to the notice. “Rather, FSA is transferring a thing of value (including, and of importance, the authority to use the FSA brand) to the recipient to carry out a public purpose of support or stimulation authorized by law, which is to improve service to students and other participants in the student financial assistance programs.”

ED wrote that it would be choosing “one or more” companies to partner with for the pilot program and will announce its decision the first week of December. It also wrote that it plans to run the pilot program for multiple schools on a voluntary basis, and that students will be able to decide whether to opt in to the trial. ED also emphasized in the solicitation that the chosen company or companies are not to use customer data for marketing purposes without explicit permission from users, and that “pilot implementer(s) will be required to provide noncustomer specific, aggregated or disaggregated program-related information to FSA by way of reports that ensure the anonymity of participating customers.”

“Receiving federal student aid may be the first encounter a student has with a financial services product, as well as his or her first experience with the government,” ED wrote. “As such, the FSA Payment Vehicle Account program presents a unique opportunity for FSA and the government to demonstrate a positive customer experience, and to bring into focus for the student that the federal government, through FSA, is the originating source of their federal student aid.”

Publication Date: 10/17/2018

You must be logged in to comment on this page.